As the cryptocurrency landscape continues to evolve, so too does the technology that enables users to store, send, and receive digital assets. Crypto wallets, once seen as simple storage solutions for digital currency, have grown into sophisticated tools that integrate various functions, from security to trading to decentralized finance (DeFi) applications MetaMask. The journey of the crypto wallet reflects the broader progression of the crypto ecosystem itself, and understanding its evolution is key to grasping how we interact with digital currencies today.

The Beginning: Digital Storage Solutions

When Bitcoin was first introduced in 2009, crypto wallets were, in essence, simple digital storage mechanisms. These wallets stored private keys—the cryptographic keys necessary to access and transfer the cryptocurrency associated with them. Early wallet solutions were primarily desktop-based, where users would download and store their private keys on their computers.

The early years of crypto wallets were focused purely on functionality: ensuring that users could securely store their private keys and transact with digital currencies. While essential, these wallets were often challenging to use, with limited options for security and backup. Furthermore, user experience (UX) was rudimentary, which made it difficult for mainstream users to adopt the technology.

The Rise of Mobile and Web-Based Wallets

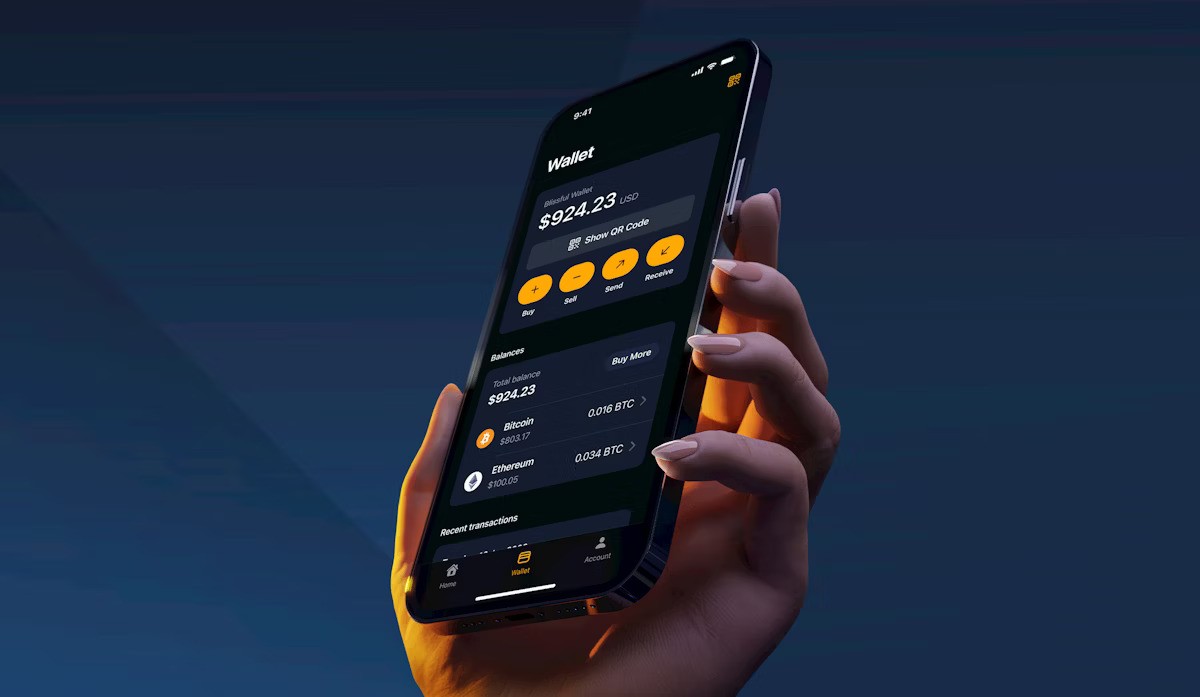

As cryptocurrencies gained in popularity, the demand for more user-friendly wallets grew. Developers began creating mobile and web-based wallets to cater to a broader audience. These wallets made it easier for users to access their funds on the go, enabling them to store their private keys on their smartphones and use wallets via browsers or apps. This was a turning point for crypto wallets, as it marked the transition from niche users to a more mainstream adoption of cryptocurrency.

The rise of mobile wallets also coincided with an increase in security features. Multi-signature wallets, for example, emerged as a way to require more than one private key to authorize a transaction, thus improving security. Other wallets began offering features like two-factor authentication (2FA) and encrypted backups, addressing one of the biggest concerns with crypto storage: the risk of losing access to funds due to lost private keys or hacked devices.

The Birth of Non-Custodial Wallets and Decentralized Finance

The next major development in the crypto wallet space was the rise of non-custodial wallets. Unlike custodial wallets, where a third party (like an exchange) controls the private keys on behalf of the user, non-custodial wallets allow individuals to retain full control over their private keys and assets. This trend has empowered users to interact with decentralized networks directly, eliminating the need for intermediaries and aligning with the core principles of decentralization that cryptocurrency was built on.

With the advent of decentralized finance (DeFi) applications, wallets began to evolve from simple storage tools into integral hubs for managing various DeFi activities. These wallets allowed users to access lending platforms, liquidity pools, decentralized exchanges (DEXs), and other blockchain-based services directly from the wallet interface. The integration of DeFi features into wallets has transformed them into comprehensive financial hubs, offering services like staking, yield farming, and governance voting—all without the need for a central authority.

Integration with NFTs and Cross-Chain Functionality

As non-fungible tokens (NFTs) became a cultural phenomenon, crypto wallets also had to adapt to store and manage these unique digital assets. The ability to hold and interact with NFTs is now a standard feature in many crypto wallets, with users able to view, buy, sell, and transfer NFTs directly from their wallets.

Additionally, the growing trend of cross-chain interoperability has led to the creation of wallets that can interact with multiple blockchains. No longer limited to just Ethereum or Bitcoin, users now have wallets that support assets across various blockchain ecosystems, such as Solana, Avalanche, and Binance Smart Chain. This has enabled more seamless interaction with a variety of dApps and has further expanded the functionality of crypto wallets.

Security: The Ongoing Battle Against Threats

As the role of crypto wallets has evolved, so too has the need for advanced security measures. Crypto wallets have become prime targets for hackers, and as the value of digital assets has skyrocketed, so has the sophistication of threats. In response, wallet developers have implemented several advanced security protocols, such as hardware wallets, biometric authentication, and multi-layered encryption.

Hardware wallets, in particular, have gained popularity as a secure solution for long-term storage of cryptocurrencies. These wallets store private keys offline, making them resistant to online hacking attempts. They are widely considered one of the safest ways to protect cryptocurrency holdings, particularly for users with large amounts of digital assets.